How to Buy Property as a Foreigner: Country-by-Country Guide

How to Buy Property as a Foreigner: Country-by-Country Guide

Are you a non-resident looking to dive into the world of international real estate investing? Buying property as a foreigner can seem daunting. But with the right guidance, you can unlock a world of opportunities. This comprehensive guide will walk you through the essential steps, legal requirements, and country-specific regulations to help you successfully purchase property abroad.

Key Takeaways

- Understand the legal rights and restrictions for non-residents when buying property in different countries.

- Explore the common challenges and financial considerations of cross-border real estate transactions.

- Discover the most popular countries for foreign real estate investment and their unique opportunities.

- Learn about the necessary legal documentation, visa requirements, and tax implications for international buyers.

- Uncover effective strategies for working with local real estate agents and managing your overseas property.

Whether you’re a seasoned investor or a first-time buyer, this guide will equip you with the knowledge and tools needed to confidently navigate the global property market. Let’s dive in and explore the world of international real estate investing, one country at a time.

Understanding Foreign Property Investment Basics

Investing in foreign property can be thrilling and profitable. Yet, it comes with unique challenges. As a non-resident buyer, knowing the legal rights, restrictions, and financial aspects of cross-border real estate is key.

Legal Rights and Restrictions for Non-Residents

Every country has its own rules for non-resident property ownership. Some might limit the type of property, its location, or the amount of foreign ownership. It’s vital to check the specific laws and any limits before buying.

Common Challenges in Cross-Border Real Estate

- Language and cultural barriers: Buying property abroad can be tough for those who don’t speak the local language or understand the customs.

- Currency fluctuations: Changes in exchange rates can affect the property’s cost and the investment’s value.

- Unfamiliar bureaucratic processes: The paperwork for foreign property ownership can be complex and time-consuming compared to buying at home.

Financial Considerations for International Buyers

Foreign buyers must think about several financial aspects when investing in cross-border real estate transactions. This includes mortgage availability, tax implications, and the total cost of owning the property. Also, understanding the local rental market and income potential is crucial for evaluating the investment’s financial viability.

“Navigating the complexities of non-resident property buyers requires careful planning and research, but the rewards can be significant for those willing to take on the challenge.”

Buy Property as a Foreigner: Essential Requirements

Buying property overseas is exciting but can be complex for non-residents. To buy foreign real estate, you need to know and meet several key requirements. This section covers the main steps and rules for buying property abroad.

Necessary Documentation

You’ll need many documents to buy property as a foreigner. These include a valid passport, proof of income or assets, and any country-specific permits. You might also need a criminal background check or other legal papers.

Legal Procedures

The legal steps for owning foreign property differ by country. It’s important to learn about the laws for non-resident property buyers in your target area. You’ll need to deal with bureaucracy, get approvals, and know any ownership limits.

Country-Specific Regulations

Every country has its own rules for foreign property buyers. Some places limit what foreigners can buy, how much they can own, or where they can invest. Make sure to check the specific rules in your chosen location to avoid problems.

| Country | Ownership Restrictions for Foreigners | Required Documentation |

|---|---|---|

| Spain | No restrictions on foreign property ownership | Passport, Proof of Income, NIE Number |

| Thailand | Foreigners can own up to 49% of a condominium building | Passport, Proof of Funds, Work Permit |

| United States | No restrictions on foreign property ownership | Passport, Proof of Income, Social Security Number |

Understanding the rules for buying property abroad can be tough. But with the right information and planning, you can buy your dream property overseas. Knowing what documents you need, the legal steps, and the specific rules for your country will help you succeed.

Popular Countries for Foreign Real Estate Investment

Investing in real estate across borders is becoming more popular. The world is getting closer, and people want to buy prime real estate in key places. Let’s look at some countries that foreign buyers are interested in.

European Property Markets

Europe is a top choice for real estate investors. Spain, Portugal, and Italy are known for their culture, beauty, and investment chances. They have stable economies, good tax rules, and the chance for property value to go up.

Asian Investment Opportunities

Asian markets are also attracting foreign investors. Countries like Thailand, Malaysia, and Japan offer strong economies, growing infrastructure, and a big middle class. This drives demand for homes and business spaces.

North American Real Estate Options

In North America, the U.S. and Canada are favorites for investors. They have strong economies, stable politics, and clear laws. These make them great for long-term investments or a second home.

| Country | Key Factors | Investment Potential |

|---|---|---|

| Spain | Vibrant tourism, favorable tax rates, strong economy | High demand for luxury properties, especially in coastal regions |

| Thailand | Thriving economy, growing middle class, affordable properties | Opportunities in both residential and commercial sectors |

| United States | Stable political climate, diverse investment options, transparent real estate market | Attractive for long-term investments and second home purchases |

These are just a few examples of where you can invest in real estate globally. By looking at these places, you can find the right investment for your goals and risk level.

Financial Planning and Mortgage Options Abroad

Buying a property abroad needs careful financial planning. When looking at expatriate home purchasing or global property investment, knowing the lending rules, currency issues, and financing choices in different places is key.

Getting a mortgage as a foreign buyer can be tough. International lenders have their own rules and approval steps that change by country. It’s smart to look into the usual mortgage types, interest rates, and down payment needs in your chosen area.

- Learn about local banks and their rules for non-resident buyers.

- Check if mortgages are in your home currency or the local one.

- See how exchange rates and currency changes affect your monthly payments.

There are other ways to finance your purchase too. You might use your savings, get a loan from back home, or use retirement funds. Talking to financial advisors who know global property investment can help you plan well.

“Navigating the financial landscape of international real estate can be complex, but with the right guidance, you can find creative solutions to fund your dream of owning a property abroad.”

By thinking about your money, looking at different loan options, and getting advice from experts, you can boost your chances of buying a home abroad. This way, you can make smart choices about your global property investment.

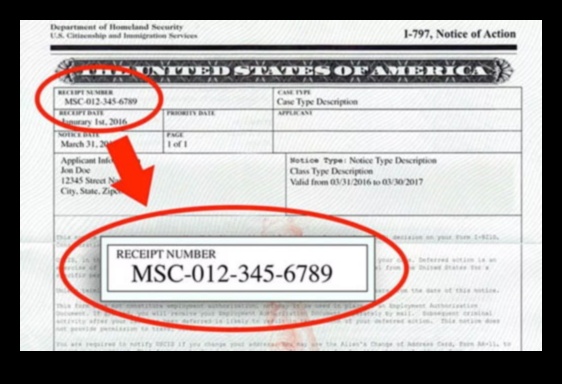

Legal Documentation and Visa Requirements

Buying property abroad can be tricky. You need to get the right permits and understand visa programs. It’s also important to follow tax rules. We’ll look at what you need to know about owning property outside your country.

Required Permits and Licenses

Investing in foreign property means following local laws. You’ll need to get permits and licenses. Here are some examples:

- Business registration or incorporation certificates

- Construction permits for any renovations or new builds

- Ownership or residency permits, depending on the country’s laws

- Tax registration and compliance documents

Property-Related Visa Programs

Many countries have visa programs for foreign property owners. These can help you get residency or even citizenship. Here are a few:

- Golden Visa programs in countries like Portugal, Spain, and Greece

- Investor visa programs in countries like the United States, Canada, and Australia

- Citizenship by Investment programs in nations like the Caribbean islands

Tax Documentation Guidelines

Understanding taxes is key when owning property abroad. You’ll need to follow certain rules. This includes:

- Submitting tax returns in both your home country and the country where the property is located

- Getting tax clearance certificates or other documents needed for the property transfer

- Keeping detailed records of all financial dealings with the property

Knowing the legal steps and visa needs helps you own property abroad smoothly. It makes your investment journey easier and more successful.

Property Search and Evaluation Process

Looking to buy property abroad can feel overwhelming. But, with the right steps, you can find your dream home. Start by learning about the local real estate market. Know the average prices, rental income, and market trends to have clear goals.

After finding properties you like, it’s time for a detailed inspection. This step lets you check the property’s condition, any needed fixes, and the area. It’s smart to get help from a local expert or inspector for their professional view.

| Key Factors to Evaluate | Considerations |

|---|---|

| Property Condition | Structural integrity, age, maintenance history, potential renovation costs |

| Location and Amenities | Proximity to transportation, schools, hospitals, shopping, and other important facilities |

| Rental Potential | Comparable rental rates, occupancy rates, and demand for short-term or long-term leases |

| Legal and Regulatory Compliance | Ensure the property is legally owned and can be transferred to a foreign buyer |

By looking closely at the property’s state, location, and money-making potential, you can make a smart choice. Remember, finding the right property takes time, effort, and a good understanding of the local market.

“Investing in international real estate requires a deep understanding of the local market and a commitment to thorough research and evaluation. Take the time to explore all aspects of a potential property to ensure it’s the right fit for your investment strategy.”

Working with International Real Estate Agents

Buying property abroad as a non-resident requires a good local real estate agent. They know the local market well and can find great investment spots. But, it’s key to know the agreement and how to communicate to avoid any issues.

Finding Reliable Local Representatives

It’s important to find a good local agent. Ask people you trust or check with industry groups. Choose agents who know the local market and have worked with non-residents before.

Understanding Agency Agreements

Read the agency agreement carefully. Know what the agent does, their pay, and how to end the deal. Talk about the terms to make sure they work for you.

Communication and Cultural Considerations

- Make sure you and your agent can talk easily and know how to respond to each other.

- Remember, cultural differences can affect the deal. They might change how you negotiate or what you need to do legally.

- Ask your agent about local customs to make the deal go smoothly and show respect.

Working with a good local agent and understanding the agreement and culture can help non-residents buy property abroad. It makes the process easier and more confident.

Tax Implications and Financial Regulations

Buying property in a foreign land comes with complex tax and financial rules. As a non-resident, knowing about property taxes, capital gains taxes, and international tax treaties is key. This knowledge helps ensure a smooth transaction across borders.

Property taxes vary by country and even within regions. This can greatly affect your investment. Also, capital gains taxes on selling the property differ widely. It’s crucial to look into these rates and any tax treaties that might help.

| Country | Property Tax Rate | Capital Gains Tax Rate |

|---|---|---|

| United Kingdom | 0.3% – 1.2% of property value | 18% – 28% of capital gain |

| Spain | 0.4% – 1.1% of property value | 19% – 23% of capital gain |

| Canada | 0.6% – 2.5% of property value | 0% – 50% of capital gain (depending on residency status) |

Financial regulations for cross-border real estate are also crucial. These include rules on foreign ownership, capital transfer limits, and financial document needs. It’s vital to research these rules to avoid legal or financial issues.

Understanding tax and financial rules for foreign property ownership helps buyers make smart choices. It allows them to confidently handle the complexities of international real estate deals.

Property Management and Rental Considerations

Buying a home abroad can be exciting but managing it from far away is tricky. Yet, with the right tools and strategies, you can handle it well. This way, you can make the most of your investment.

Remote Property Management Solutions

Thanks to new tech, managing your property from afar is easier. There are many solutions out there. These include:

- Specialized companies that take care of everything from finding tenants to fixing things

- Online platforms that make managing your property simple, from collecting rent to reporting

- Virtual assistants who can help with daily tasks and act as your local contact

Rental Market Analysis

Understanding the local rental market is key. Knowing average rents, how often places are rented, and seasonal changes helps. This knowledge lets you set good prices, market your property well, and manage it effectively.

Legal Requirements for Foreign Landlords

As a non-resident landlord, knowing the law is crucial. You might need special licenses or to register as a foreign landlord. Staying legal can be tricky, but a real estate lawyer can guide you. They help you avoid legal issues.

Risk Mitigation and Insurance Requirements

Investing in buy property as a foreigner or international real estate is exciting but risky. It’s key to focus on reducing risks and knowing the insurance you need. This will protect your investments abroad.

First, get comprehensive property insurance. The type of insurance needed varies by country and location. You might need coverage for natural disasters or civil unrest. Look for a good insurance provider in your area.

Don’t forget about liability insurance. Having a foreign property can lead to legal issues. Umbrella policies or specialized insurance can help. They offer extra protection and peace of mind.

- Understand the local insurance requirements and regulations in your chosen investment destination.

- Evaluate your property’s unique risks and tailor your insurance coverage accordingly.

- Consider additional liability protection to guard against potential legal issues.

- Work with a reputable insurance provider who is familiar with the nuances of international real estate investing.

| Insurance Coverage | Key Considerations |

|---|---|

| Property Insurance | Natural disasters, civil unrest, coverage for landlord or tenant damage |

| Liability Insurance | Personal injury claims, property damage, legal issues |

| Title Insurance | Protecting your ownership rights and interests |

By focusing on risk reduction and insurance, you can confidently invest in buying property as a foreigner. This will help secure your international real estate.

Conclusion

Buying property as a foreigner can be rewarding and profitable. But, it needs careful research and professional help. You must also understand the legal and financial sides of global property investment.

Looking at European, Asian, or North American real estate? It’s key to know the unique challenges and rules of buying abroad. You’ll face complex laws, visa issues, and financing hurdles. But, with the right steps, you can succeed in cross-border real estate.

Starting your foreign property buying journey? Focus on thorough research and expert advice. Keep up with market trends and rules. This way, you can avoid risks, make good profits, and enjoy the benefits of international real estate.

FAQ

What are the legal rights and restrictions for non-residents when buying property abroad?

Legal rights and restrictions for non-residents vary by country. Some places have strict rules for foreign buyers. You might need special permits or face limits on what you can buy.

It’s key to research the laws in your chosen location. This way, you’ll know your rights and what you must do as a foreign buyer.

What are the common challenges in cross-border real estate transactions?

Buying property across borders can be tough. You’ll face complex laws, finding financing, and dealing with currency risks. Language and cultural differences also add to the challenge.

Working with local experts can help. They can guide you through these hurdles and make the process smoother.

What are the key financial considerations for international property buyers?

International buyers need to think about several financial aspects. Exchange rates, currency controls, and mortgage options are crucial. Property taxes and capital gains taxes also play a role.

Understanding these financial aspects is vital. It helps ensure your investment is sound and viable.

What are the essential requirements for foreigners looking to purchase property abroad?

Foreigners need to meet certain requirements to buy property abroad. You’ll need permits, understand local laws, and follow foreign ownership rules. Local experts can help you navigate these steps.

What are some popular destinations for foreign real estate investment?

Popular spots for foreign investment include Spain, Portugal, and the UK in Europe. Asia’s Thailand, Malaysia, and Japan are also favorites. The US and Canada in North America draw a lot of interest too.

The appeal of each market varies. It depends on factors like economic stability, property prices, and rental yields.

What are the typical mortgage options available to foreign property buyers?

Mortgage options for foreign buyers differ by country. You might find local bank loans, international mortgages, or lenders for non-residents. It’s important to explore your options and find the best fit for your investment.

What legal documentation and visa requirements are associated with buying property as a foreigner?

Foreign buyers need various documents and visas. This includes permits, licenses, and property visas. Tax documents are also necessary. The specific requirements depend on the country’s laws.

It’s crucial to research and comply with all necessary steps. This ensures you meet the legal and administrative requirements.

How can foreign buyers effectively search for and evaluate properties in unfamiliar markets?

Searching for properties abroad requires research and inspections. Understanding local trends and property values is key. Working with a local agent can provide valuable insights and guidance.

What should foreign buyers consider when working with international real estate agents?

When choosing agents, look for reliable local experts. Understand agency agreements and navigate cultural differences. A good agent can greatly enhance your investment success.

What are the tax implications and financial regulations associated with foreign property ownership?

Taxes and regulations for foreign property vary by country. Buyers should look into property and capital gains taxes. International tax treaties can also affect your investment.

Seeking advice from tax and financial experts is wise. They can help you comply with laws and minimize risks.

How can foreign property owners effectively manage their investment properties remotely?

Remote management is possible with the right tools and services. Consider hiring local property managers or using technology. It’s also important to understand local rental laws and plan for maintenance and tenant management.

What risk mitigation strategies and insurance requirements should foreign property buyers consider?

Investing abroad requires careful risk management. Secure comprehensive insurance and liability protection. Researching local risks and insurance needs is crucial for protecting your investment.

![Sheffield International Postgraduate Merit Scholarships [year]/[nyear] 10 Sheffield International Postgraduate Merit Scholarships](https://lessmag.net/wp-content/uploads/2025/04/University-of-Sheffield-International-Postgraduate-Merit-Scholarship-390x220.jpg)